Precious metals advocates have been warning for years that the time to load up on a safe haven asset is before it’s needed, because by the time it is obviously needed it won’t be available. That seemed a bit hyperbolic in a world of smoothly functioning markets and apparently infinite horizons of steady growth and diminishing risk.

But that world is gone and just as Jim Rickards, Peter Schiff et al predicted, everyone suddenly wants gold and silver coins. And no one can get them. The US Mint is out of silver eagles and the Royal Canadian Mint has temporarily ceased operations. Even the miners themselves are closing due to coronavirus concerns. Here’s what the US Mint’s silver eagle sales looked like before they ran out:

The result: Massive new demand hits flat to diminishing supply, resulting in shortages, delays, and soaring premiums. Prices in the gold and silver futures markets — where speculators who have no intention of actually taking delivery can shove prices around at will — are down dramatically, but in the physical market, where actual metal changes hands, a silver eagle might cost one third to one half more than the (paper) spot price. And supplies are still constrained at those higher prices.

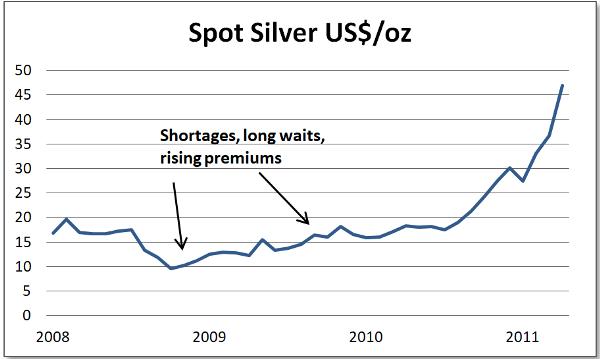

Something similar happened back in 2008, when precious metals prices tanked along with stocks in general, causing demand for gold and silver coins to soar, dealers and mints to run out of inventory and both premiums and wait times to jump. This was followed by an epic bull market in precious metals.

John Rubino-Dollar Collapse-March 22, 2020