Frequently Asked Questions: Owning Precious Metals

CALL TODAY TO GET STARTED!

800.528.0545

Don't Hesitate To Reach Us

Call us today at 1-800-528-0545 and speak with one of our knowledgeable account executives. Learn why American Gold Metals, is establishing the “new gold standard” by which other Precious Metals companies are being measured.

The Basics of Metals Ownership

Possessing physical precious metals—such as gold, silver, platinum, and palladium—offers unique benefits for a balanced portfolio. They serve as a powerful hedge against inflation and economic uncertainty, as their value often increases when traditional investments like stocks and currencies decline. Precious metals are tangible assets, providing a secure store of value that is independent of the banking system and geopolitical instability.

While both gold and silver are excellent hedges against economic volatility, they serve different purposes. Gold is often seen as the ultimate safe haven and primary store of wealth, primarily driven by investment demand. Silver is more volatile but offers strong growth potential due to its significant industrial demand in technologies like solar panels and electronics, making it both a precious metal and an industrial commodity.

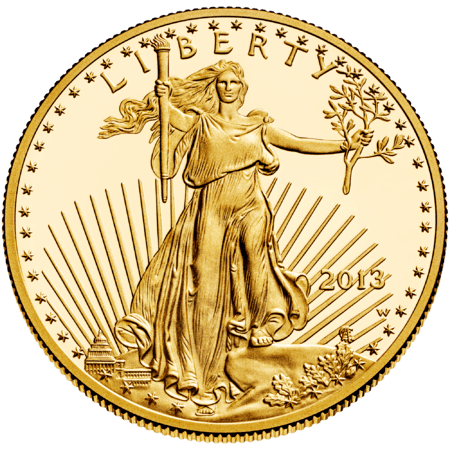

Bullion represents precious metals that are valued mainly for their content and weight, usually found in the form of bars, rounds, or sovereign coins such as American Eagles or Canadian Maple Leafs. Numismatic coins are valued for their rarity, condition, and historical significance, often selling for a premium well above the metal's intrinsic value.

Acquisition and Pricing

The valuation of precious metals is determined by the global spot price, which represents the current market price for immediate delivery. The spot price is influenced by supply and demand, geopolitical events, interest rates, and currency strength. When acquiring physical metals, the amount you pay includes a premium above the spot price, which accounts for manufacturing, distribution, and dealer costs.

The safest way to buy physical precious metals is by purchasing from a reputable dealer with a proven track record. Ensure the dealer offers secure, insured shipping and provides certificates of authenticity or verified hallmarks for all products.

The most common forms are bullion coins (such as American Gold and Silver Eagles, Krugerrands, Maple Leafs) and bullion bars. Coins typically offer greater liquidity and are recognized globally, while bars are often favored for larger acquisitions due to lower premiums.

Storage and Security

The choice of where to keep your metals is determined by the quantity you possess and your desire towards accessibility in contrast to security. Options include:

- Home Safe: Offers immediate access, but requires a high-quality, fireproof safe and potentially specialized home insurance.

- Bank Safe Deposit Box: Offers secure storage, although access is restricted to banking hours.

- Private, Insured Depository: Professional vaults offer the highest level of security and insurance for large holdings, with segregated and audited storage options.

When purchasing from a reputable dealer, shipments are typically fully insured until they are delivered and signed for. If you opt for professional depository storage, your holdings are usually covered by the depository's comprehensive insurance policy.

Yes, you can store gold and silver in the same location, but it is highly recommended to keep them in separate protective containers or tubes. Silver is prone to tarnishing, and while gold is more resistant, preventing direct contact helps maintain the condition and aesthetic value of both metals.

Precious metals, particularly well-known bullion coins and bars, are assets that possess high liquidity. They can be easily converted to cash. American Gold Metals like most reputable dealers offer buyback programs, ensuring a straightforward process for selling your holdings based on the current spot price.

Our Seamless Process Makes Your Transaction Fast and Easy

CALL TODAY TO GET STARTED!

800.528.0545

Common IRA Eligible Products