Frequently Asked Questions

CALL TODAY TO GET STARTED!

800.528.0545

Don't Hesitate To Reach Us

Call us today at 1-800-528-0545 and speak with one of our knowledgeable account executives. Learn why American Gold Metals, is establishing the “new gold standard” by which other Precious Metals companies are being measured.

The primary difference lies in the assets they are allowed to hold.

- A Traditional IRA typically invests in conventional assets like stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

- A Gold IRA is specifically designed to hold physical precious metals, such as IRS-approved gold, silver, platinum, and palladium bullion bars and coins. The metals are held in a secure depository.

Both account types offers tax deferred growth.

Both are ways to move funds between retirement accounts, but they differ in procedure and direct control over funds:

- Transfer: This is a direct, trustee-to-trustee movement of funds from one retirement account custodian to another. The funds never pass through your hands, meaning there's no risk of a taxable event or penalties.

- Rollover: In an indirect rollover, the funds from your old retirement account are distributed to you. You then have 60 days from the date you receive the funds to deposit them into a new or existing retirement account. If you fail to deposit the full amount within this 60-day window, the distributed funds may be considered a taxable withdrawal and potentially subject to early withdrawal penalties if you're under 59½.

Generally, no. Most employer-sponsored 401(k) plans do not allow for direct investment in physical precious metals like gold bullion. 401(k)s typically offer a limited selection of mutual funds, ETFs, and other paper assets.

However, you can typically move funds from an old 401(k) (from a previous employer) into a Precious Metals IRA through a rollover or direct transfer. This allows you to diversify your retirement savings into physical gold.

No, not while they are still considered part of your IRA. For your precious metals to maintain their tax-advantaged IRA status, they must be held by an IRS-approved custodian in a secure, third-party depository.

Taking physical possession of the metals would be considered an "in-kind" distribution from your IRA. This distribution would be subject to income taxes (for a Traditional IRA) and potentially a 10% early withdrawal penalty if you are under age 59½. You can only take physical delivery once you initiate a distribution from your IRA in retirement.

The tax implications largely mirror those of a Traditional or Roth IRA:

- Traditional Gold IRA: Contributions may be tax-deductible (depending on income and other retirement plan coverage), and your gold grows tax-deferred. You will pay ordinary income tax on your distributions in retirement.

- Roth Gold IRA: Contributions are made with after-tax dollars, meaning they are not tax-deductible. However, your gold grows tax-free, and qualified distributions in retirement are also tax-free.

- Early Withdrawals: If you take distributions (cash or in-kind physical metals) before age 59½, the taxable portion of the distribution is generally subject to a 10% early withdrawal penalty, in addition to ordinary income tax.

- Required Minimum Distributions (RMDs): For Traditional Gold IRAs, you will be subject to RMDs once you reach age 73 (as of 2023).

When you reach retirement age (or decide to take an early distribution), you have two primary options:

- Cash Distribution: You can instruct your IRA custodian to sell your gold holdings. The cash proceeds from the sale are then sent to you. These funds will be subject to income tax (for Traditional IRAs) or be tax-free (for Roth IRAs, if qualified).

- In-Kind Distribution: You can request that the actual physical gold be shipped to you from the depository. This is also considered a distribution and will be valued at its fair market value on the day of the distribution. This value will then be subject to income tax (for Traditional IRAs) or be tax-free (for Roth IRAs, if qualified).

Your custodian will guide you through the necessary paperwork and processes for either type of distribution.

To convert your precious metals back to other assets within your IRA, or to cash, you would typically follow these steps:

- Sell Your Precious Metals: You instruct your Precious Metals IRA custodian to sell your gold (or other precious metals) holdings. They will work with an approved dealer to liquidate your metals at the current market price.

- Funds are Deposited in Your IRA: The cash proceeds from the sale are then deposited into the cash balance of your self-directed IRA account.

- Reinvest or Distribute:

- Reinvest: Once the funds are cash within your self-directed IRA, you can then instruct your custodian to use those funds to purchase other eligible assets that your self-directed IRA supports, such as stocks or mutual funds (if your specific custodian offers access to those types of investments within the same account).

- Distribute: Alternatively, you can take a cash distribution directly to yourself, which would be subject to the standard IRA distribution rules (taxes, potential penalties)

As a client of AGM (American Gold Metals), you will be receiving monthly portfolio analysis and updates by email and/or phone. This will allow you to be aware of market trends and be proactive in maximizing you gold investment. If circumstances warrant liquidation, we will let you know.

There are three important reasons to consider American Gold Metals Inc. After acquiring your precious metals, we provide a follow-up service designed to keep you informed on economic and/or geopolitical events that could affect the gold or silver market. Keeping you informed in real time allows you to be proactive in your decisions.

Second: We are a member of NGC (Numismatic Guarantee Corporation), PCGS (Professional Coin Grading Service) and ANA (American Numismatic Association). We are also a company with decades of precious metals experience. We believe that integrity still matters and our record of service to our clients is a priceless commodity.

Finally by substantially reducing overhead costs, and running a more efficient, customer oriented business, we are able to provide the very best prices for precious metal products.

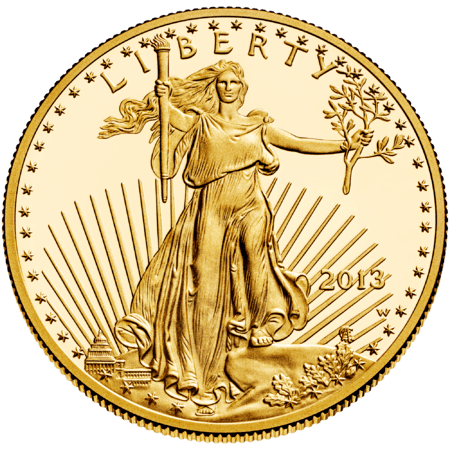

The IRS sets specific guidelines for eligible precious metals in an IRA. Generally, they must meet minimum purity standards. Eligible metals include:

- Gold: .995+ purity

- Silver: .999+ purity

- Platinum: .9995+ purity

- Palladium: .9995+ purity

Specific coins and bars must also meet IRS-approved specifications.

Setting up a precious metals IRA involves several steps:

- Choose a custodian: Select a reputable custodian specializing in self-directed IRAs that handle precious metals.

- Fund the account: Transfer or rollover funds from an existing IRA or 401(k).

- Purchase metals: Work with a dealer to buy IRS-approved precious metals.

Secure storage: Store your metals in an IRS-approved depository.

The IRS requires that precious metals held in an IRA be stored in an approved depository. You cannot store them at home. Approved depositories are typically secure, insured facilities that specialize in storing precious metals. This ensures the safety and compliance of your investment.

Our Seamless Process Makes Your Transaction Fast and Easy

CALL TODAY TO GET STARTED!

800.528.0545

Common IRA Eligible Products