Yesterday, I explained the significance of economic energy when it comes to determining what constitutes as “safe money” in these uncertain economic times.

Today I want to clarify…

Analysts can churn out thousands of statistics to make future price forecasts for just about anything.

But that doesn’t mean they’re on to anything more than one small piece of a complicated puzzle.

To understand the big financial picture, you can’t overlook other complexities that affect the value of all currencies and investments.

Instead of simply waiting for the latest Fed minutes or last month’s official job’s report, I’m going to help you go the extra mile here by showing you why those pieces of information (analytical statistics you see on Yahoo Finance!, for instance) are only the tip of the iceberg.

The reality is that our fiat monetary system has been completely corrupted by central bankers who are totally distorting values of the physical economy.

This will have remarkable effects on the cost of silver in the long, muddled road ahead…

Read on for a few key concepts (yes, even a few analytical charts) worth contemplating before you make any financial decisions.

“Economic Energy”

Energy controls everything. And the world has been in a peak energy environment since about 2005. Consequently, the inevitable rise in silver is directly correlated to energy costs.

The most basic way to look at what precious metals expert Steve St. Angelo calls “Economic Energy” is to compare and contrast how the value of gold and silver relates to a barrel of oil.

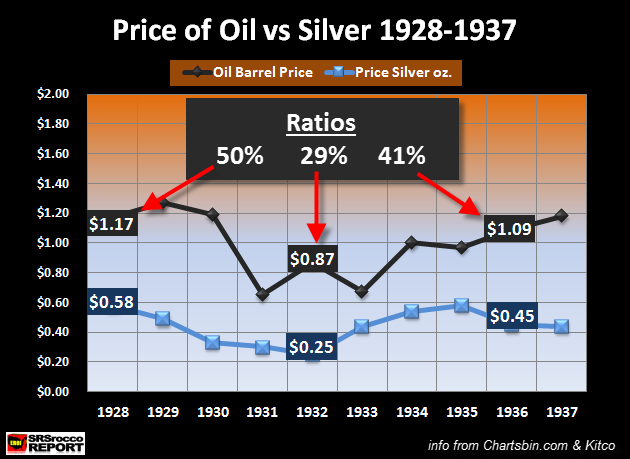

Take a look at the chart below. You can see how the price of silver compared to the price of oil during the Great Depression of the early 1930s.

Just a year before “Black Tuesday,” the epic stock market crash that led to the Great Depression in 1929, silver was worth 50% of the value of a single barrel of oil.

By 1932, a year before the Depression bottomed, silver’s value fell to 29% when compared to crude.

As the country began to recover from the Depression years, silver’s value climbed back up to 41% compared to a barrel of oil in 1936.

Those results are a typical response to deflation (a decline in money supply).

However, things changed this time around during our most recent Great Recession…

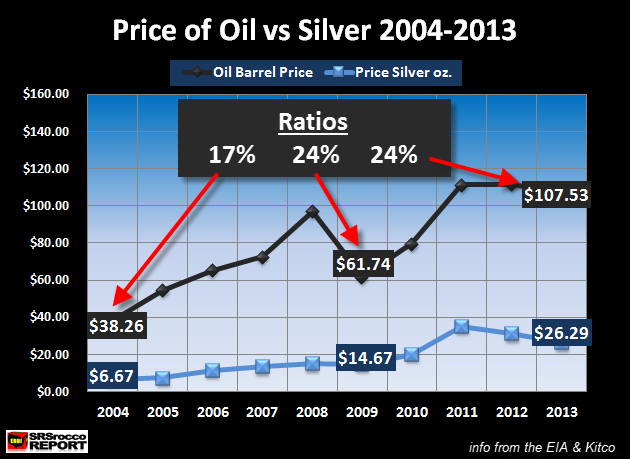

Here’s how the silver-to-oil ratio compares from the recovery of the 1930s to the “recovery of 2013”:

-

1936 = 2.4 ounces of silver to purchase a barrel of oil

-

2013 = 4.1 ounces of silver to purchase a barrel of oil

This next chart clearly shows silver regaining monetary status, slowly but surely:

In the meantime, the world is experiencing a plateau in oil production.

As the globe runs the risk of this energy depletion while people the world over are so heavily invested in huge paper debts (energy IOUs), a big problem is emerging: Those paper debts may be adequately disguised as real assets for now — but soon, smart investors are going to make the switch into truly beneficial physical assets, like gold and silver.

Once word gets out that a few big names have quietly moved towards that direction (seeking their own safe havens), the rest of the world is going to follow suit… and the laws of supply and demand will take over from there, resulting in a drastic surge in silver and gold prices.

I’d rather not jump on that bandwagon too late. I want to get in on this action before Main Street catches on — while prices are still cheap…

Energy Controls Everything

Independent Research Analyst Steve St. Angelo addresses the issues in an interview below, explaining in greater detail how the aforementioned rise of silver is directly correlated to energy costs.

Need More Convincing?

Add to this the obvious silver manipulation schemes that have been going on for the last 50 years, blatant devaluations, and insatiable industrial and investment demand, and it’s easy to understand how the white metal is going to make some bold moves in the next few years.

Production has been slacking for years, unable to meet demand for decades.

So, why haven’t prices moved in tandem?

For me, the picture here is crystal clear.

The inevitable rise of silver is dictated by a powerful myriad of factors.

If you’re interested in preserving your hard-earned wealth, wouldn’t you feel more comfortable doing so by holding a real physical asset?

Especially at a time when our economy is governed by a corrupt Federal Reserve and greedy “officials” whose tentacles extend everywhere — from the politicians in Washington… to unethical corporate CEOs scattered coast to coast… to the sticky-fingered bankers on Wall Street…

Fallible paper assets or hard physical assets: The choice is yours.

Farewell for now,

Brittany Stepniak – Outsiders Club – August 2, 2013